Borrowing money shouldn't have to be complicated.

B2B companies use Fig to automate their lending businesses, so that they can provide loans to their most trusted small-business customers, and focus on their core business.

Use Fig's APIs to automate an off-balance sheet lending business

Disburse loans to trusted small-business customers in under 5 minutes

Monitor and manage loan books in real-time, without expensive finance teams

The Liquidity Stack.

Fig's lending partners range from leading commercial banks, to alternative asset managers. All forms of B2B loans are catered for.

Fig's borrowers.

Fig's distribution partners support large ecosystems of small-businesses in sectors ranging from supply-chain, to e-commerce, pharmaceuticals, and beyond. Diversification is a feature of Fig.

Global access.

Our lender network is global, and is competing for deals. From the world's largest banks, to alternative local currency lenders, Fig can cater for all types of embedded credit programmes.

Financial inclusion.

Fig's demand-side partners run credit programmes with customers that they've transacted with for years - this means that lenders have access to untapped credit data to assess loan affordability with. Fig automates the whole process, meaning loans are disbursed in under 5 minutes.

You take the credit.

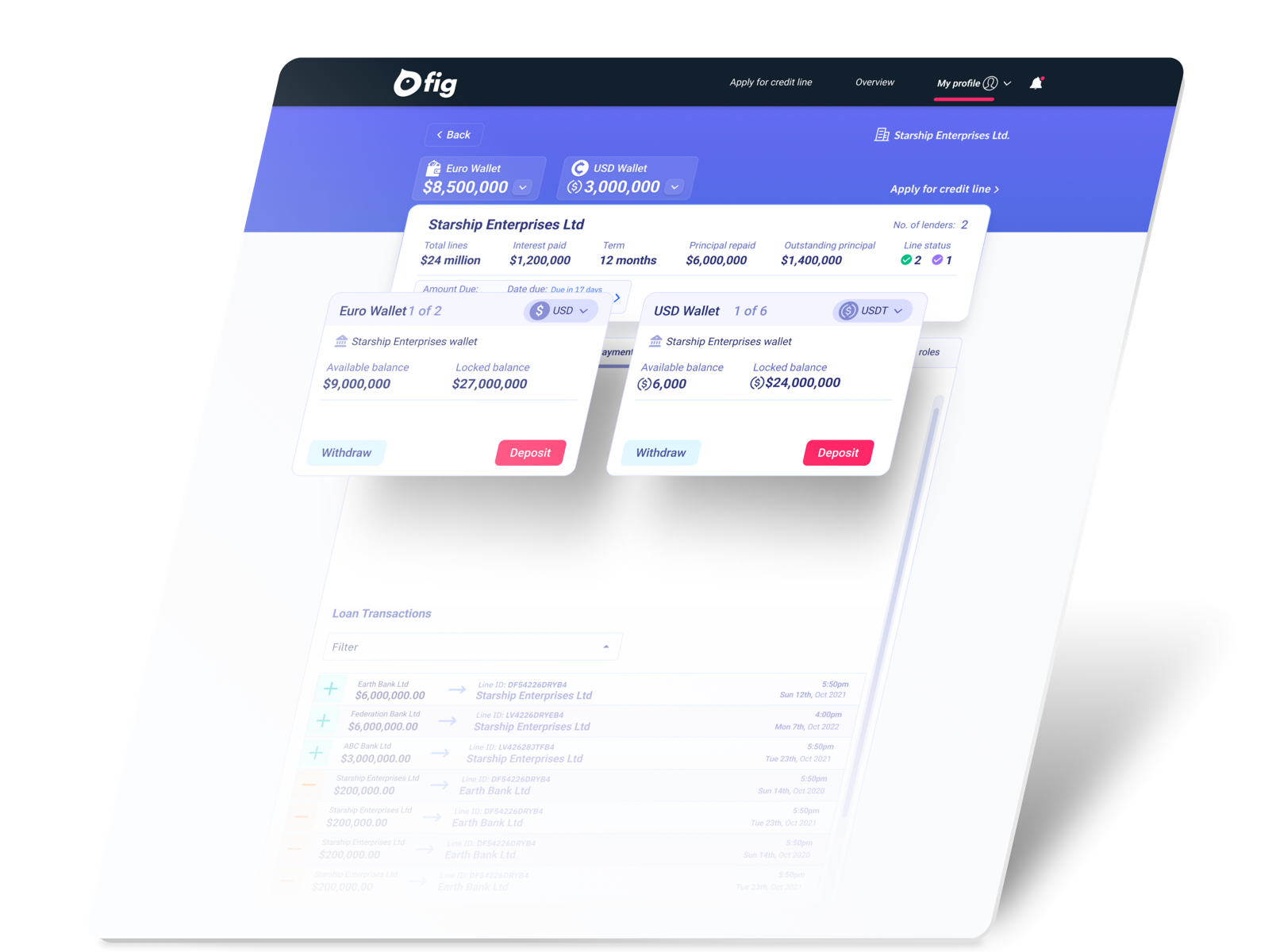

One platform acting as your whitelabelled finance department.

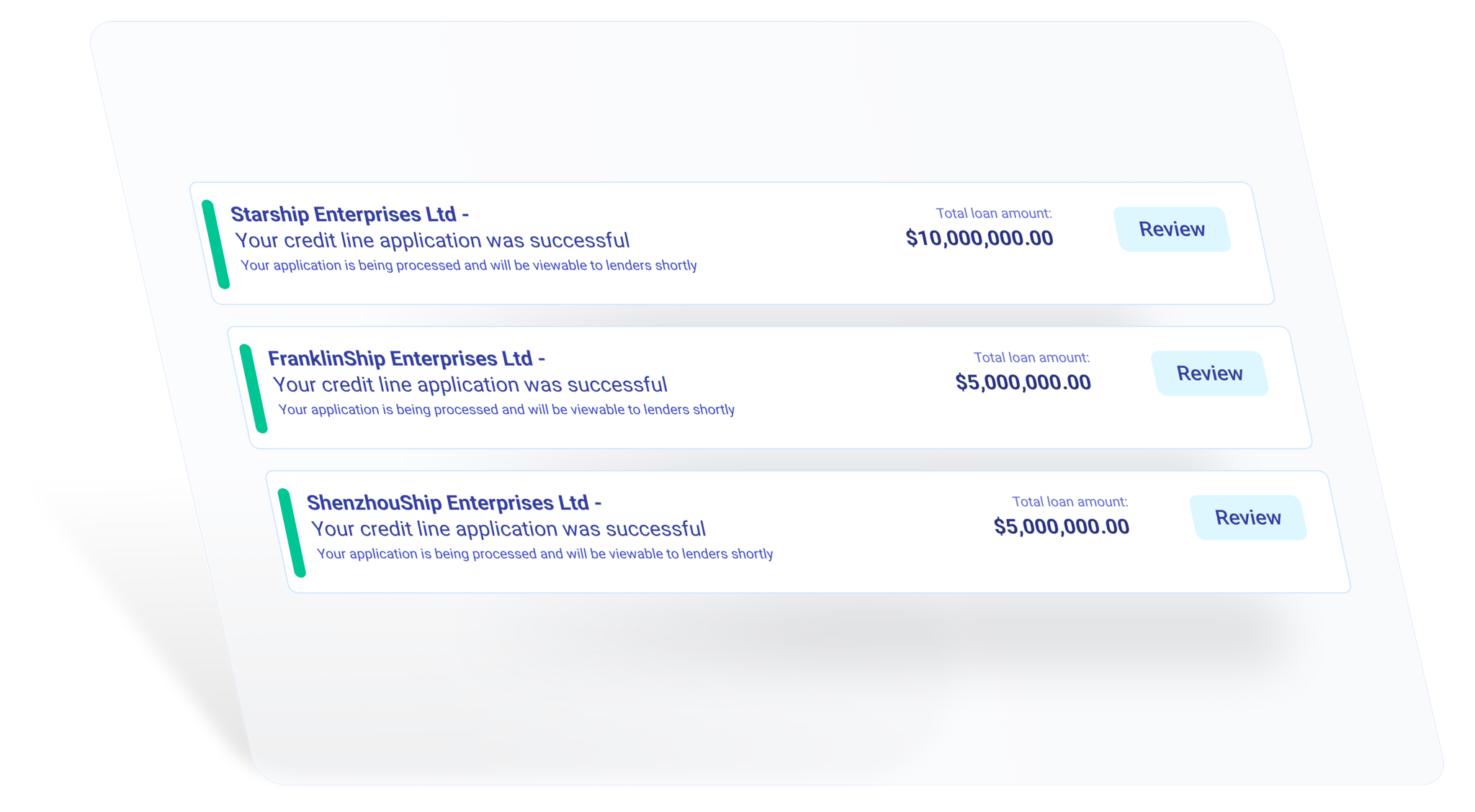

Apply for a Fig credit program.

Select one of the below options to view indicative terms. B2B customers are funded in a few steps!

Look no further! Our network is yours.

We've collected the world's most active lenders onto one platform.

The search is over. We'll find you a lender for every step of the journey.

Frequently Asked Questions

Fig's borrowers are typically Series A stage (and above) companies who have successful track records operating financing programs, or who have strong growth metrics and require debt for working capital. That being said, Fig does also work with earlier stage companies if they have a strong proposition, and can provide the lenders on our platform with relevant data feeds.

The lenders on Fig's platform range from global trade finance institutions and DFIs, to local banks, asset managers and alternative lenders - we have designed Fig's ecosystem so that you can raise debt facilities in local currency, USD and even Euros.

Fig has created an ecosystem of lenders that are comfortable lending hundreds of thousands, to hundreds of millions. We've done this so that companies aren't reliant on one or two lenders, and so that they can scale their debt requirements easily without having to spend precious months building new lender relationships as they grow - Fig delivers these relationships instantly. At the same time, Fig reduces the cost of capital for the best borrowers by having lenders bid for your business.

Fig ensures that your proprietary data is shared securely with only the lenders that agree to your confidentiality terms. We are also legally bound to make sure your data remains yours.

Fig is free to join! We only charge a transaction fee when a deal is closed successfully. This fee ranges from 0.1-1% depending on the value of the deal.